Should I open a savings account?

But if you're looking to set aside money for future needs and goals, opening a savings account is an option to consider. Saving a percentage of your income and putting it into a savings account can help you grow your savings while building a safety net fund.

Savings accounts are essential for financial health and stability. They provide a safe place to store and grow your funds while offering easy access when needed. You can use a savings account to build an emergency fund, save for large purchases, or set aside money for future needs.

Savings account benefits include safety for your savings, interest earnings and easy access to your money. However, savings accounts may have drawbacks, such as variable interest rates, minimum balance requirements and fees.

Savings accounts offer one of the simplest ways to earn interest on the money you have. They offer higher interest rates than a regular checking account, while still making it easy to spend and withdraw money.

The recommended amount of cash to keep in savings for emergencies is three to six months' worth of living expenses. If you have funds you won't need within the next five years, you may want to consider moving it out of savings and investing it.

Here's an example: Say you save $1,000 for a year in an account that pays 5% APY, compounded annually. After 12 months, you'll have $1,050. Then you'll start earning interest on $1,050, so after the second year you'll have about $1,100.

Rule of thumb? Aim to have three to six months' worth of expenses set aside. To figure out how much you should have saved for emergencies, simply multiply the amount of money you spend each month on expenses by either three or six months to get your target goal amount.

The interest rate on savings generally is lower compared with investments. While safe, savings are not risk-free: the risk is that the low interest rate you receive will not keep pace with inflation.

Your money is invested, so the balance can go up and down with regular market activity. High-yield savings accounts, on the other hand, are not tied to the stock market. As such, the risk of losing money is extremely low. Even if your financial institution fails, FDIC insurance can cover a large portion of your losses.

If you do, opening an account at a bank or credit union is straightforward. The interest they pay for savings accounts You usually need to make an initial deposit between $25 and $100 to open a savings or checking account.

Is it better to save cash or open a savings account?

But putting your money into a savings account is a much better bet for a few reasons. First, when you keep physical cash around, you never know when it might get lost or stolen. You might, for example, take some bills out of your cash jar to count them, only to accidentally drop a $20 behind your dresser.

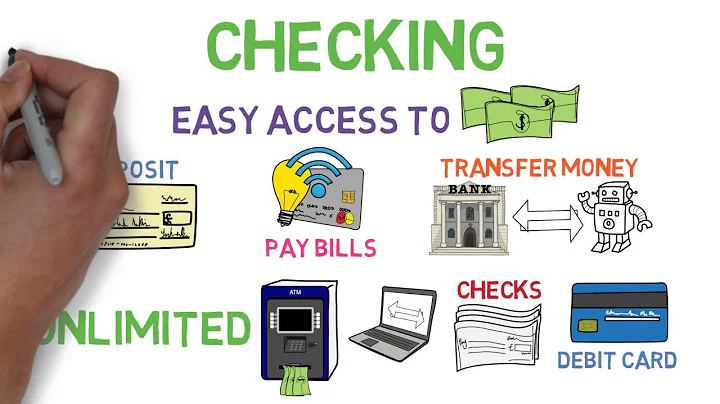

In the comparison above, you can see how checking accounts are the better choice for daily financial tasks since they offer debit card access and have no limit on withdrawals. Because of their withdrawal limits and interest earnings, savings accounts are a better fit for the money you're saving for financial goals.

How much do you need? Everybody has a different opinion. Most financial experts suggest you need a cash stash equal to six months of expenses: If you need $5,000 to survive every month, save $30,000.

Having $20,000 in a savings account is a good starting point if you want to create a sizable emergency fund.

Moreover, according to a study by Bank of America, millionaires keep 55% of their wealth in stocks, mutual funds, and retirement accounts. Millionaires and billionaires keep their money in different financial and real assets, including stocks, mutual funds, and real estate.

The idea is to divide your income into three categories, spending 50% on needs, 30% on wants, and 20% on savings.

The future value of $10,000 with 6 % interest after 5 years at simple interest will be $ 13,000.

So, if the interest rate is 6%, you would divide 72 by 6 to get 12. This means that the investment will take about 12 years to double with a 6% fixed annual interest rate.

$3,000 X 12 months = $36,000 per year. $36,000 / 6% dividend yield = $600,000. On the other hand, if you're more risk-averse and prefer a portfolio yielding 2%, you'd need to invest $1.8 million to reach the $3,000 per month target: $3,000 X 12 months = $36,000 per year.

Nearly one in four (22 percent) U.S. adults said they have no emergency savings. Despite economic challenges, the percentage remains relatively unchanged year-over-year. In 2022, 23 percent of Americans had no emergency savings.

How many Americans live paycheck to paycheck?

Statistics vary, but between 55 percent to 63 percent of Americans are likely living paycheck to paycheck.

We found that 15% of income per year (including any employer contributions) is an appropriate savings level for many people, but we recommend that higher earners aim beyond 15%. So to answer the question, we believe having one to one-and-a-half times your income saved for retirement by age 35 is a reasonable target.

It is very much possible that too much money in a savings account can either earn little or no interest. One of the major reasons why keeping a lot of money in a savings account might not be a wise decision is the change in repo rates.

How much is too much? The general rule is to have three to six months' worth of living expenses (rent, utilities, food, car payments, etc.)

Rest assured, high-yield savings accounts from insured banks and credit unions are some of the safest places to keep your money — as a type of deposit account, your high-yield savings account is insured (up to limits), not subject to any market volatility and easily accessible.

References

- https://www.citizensbank.com/learning/multiple-checking-account-benefits.aspx

- https://www.experian.com/blogs/ask-experian/are-high-yield-savings-accounts-safe/

- https://www.chase.com/personal/credit-cards/education/build-credit/opening-a-bank-account-with-bad-credit

- https://www.nerdwallet.com/article/banking/how-much-money-in-checking-and-savings

- https://www.quora.com/Can-banks-see-your-other-bank-accounts

- https://www.zeebiz.com/personal-finance/news-is-keeping-too-much-money-in-savings-account-a-bad-financial-decision-stst-255577

- https://www.wsj.com/articles/credit-card-salary-income-money-112c089a

- https://www.investopedia.com/ask/answers/052515/how-savings-account-taxed.asp

- https://www.businessinsider.com/personal-finance/how-much-should-i-save-each-month

- https://www.creditstrong.com/raise-your-credit-score-100-points/

- https://www.capitalone.com/learn-grow/money-management/how-many-bank-accounts-to-have/

- https://www.quora.com/Is-it-illegal-to-have-multiple-bank-accounts

- https://www.transunion.co.uk/consumer/credit-report-help/why-cant-i-see-some-of-my-financial-accounts-on-my-credit-report

- https://www.investopedia.com/how-many-savings-accounts-should-i-have-7775519

- https://www.investopedia.com/what-credit-score-do-you-need-to-buy-a-car-5181034

- https://www.banks.com/articles/banking/savings-accounts/savings-accounts-advantages-disadvantages/

- https://www.bankrate.com/banking/savings/emergency-savings-report/

- https://www.iob.in/upload/CEDocuments/Savings_Bank_Rules.pdf

- https://financebuzz.com/banks-millionaires-use

- https://smartasset.com/checking-account/does-opening-a-savings-account-affect-your-credit-score

- https://borrowell.com/blog/i-have-a-zero-credit-score-now-what

- https://www.sofi.com/learn/content/does-opening-a-checking-or-savings-account-affect-credit-score/

- https://www.investopedia.com/articles/personal-finance/040915/how-much-cash-should-i-keep-bank.asp

- https://www.wcpo.com/money/consumer/dont-waste-your-money/why-you-should-never-keep-all-your-money-in-one-bank

- https://www.troweprice.com/personal-investing/resources/insights/youre-age-35-50-or-60-how-much-should-you-have-by-now.html

- https://www.nerdwallet.com/ca/banking/multiple-bank-accounts

- https://files.consumerfinance.gov/f/documents/cfpb_adult-fin-ed_checklist-for-opening-an-account.pdf

- https://byrdbarrplace.org/programs-services/personal-finance/behavior-negative-credit-score/

- https://www.forbes.com/advisor/banking/cannot-open-bank-account/

- https://www.nerdwallet.com/article/banking/accounts-at-multiple-banks

- https://www.investopedia.com/financial-edge/0212/common-things-that-improve-and-lower-credit-scores.aspx

- https://www.businessinsider.com/personal-finance/how-to-open-high-yield-savings-account-online-save-money

- https://time.com/personal-finance/article/what-is-a-savings-account/

- https://www.cbsnews.com/news/should-i-move-all-of-my-money-to-a-high-yield-savings-account/

- https://www.myfico.com/credit-education/credit-scores/new-credit

- https://www.forbes.com/advisor/banking/savings/how-many-savings-accounts-should-i-have/

- https://www.unfcu.org/financial-wellness/50-30-20-rule/

- https://www.fool.com/the-ascent/banks/articles/heres-what-happens-if-you-deposit-more-than-10000-in-cash-into-your-bank-account/

- https://www.creditkarma.com/advice/i/what-affects-your-credit-scores

- https://www.experian.co.uk/consumer/guides/what-affects-score.html

- https://www.investopedia.com/why-have-multiple-savings-accounts-now-7510818

- https://www.jeniusbank.com/blog/articles/savings-categories-and-buckets

- https://www.nerdwallet.com/article/finance/raise-credit-score-fast

- https://www.experian.com/blogs/ask-experian/credit-education/improving-credit/improve-credit-score/

- https://finance.yahoo.com/news/20-000-good-amount-savings-160036732.html

- https://homework.study.com/explanation/which-of-the-following-is-not-a-benefit-of-putting-money-in-a-savings-account-a-you-can-make-frequent-withdrawals-b-you-can-earn-interest-c-it-is-harder-to-spend-the-money-d-the-money-is-safe-and-secure.html

- https://www.experian.com/blogs/ask-experian/can-opening-a-new-account-hurt-my-credit-score/

- https://www.cuemath.com/questions/what-is-the-future-value-of-dollar10000-on-deposit-for-5-years-at-6-simple-interest/

- https://www.cnbc.com/select/how-many-savings-accounts-should-i-have/

- https://www.moneylion.com/learn/credit-score-dropped-100-points/

- https://www.nerdwallet.com/article/banking/how-many-savings-accounts-should-i-have

- https://www.bankrate.com/banking/savings/reasons-multiple-savings-accounts/

- https://www.fool.com/the-ascent/banks/articles/why-saving-cash-in-a-jar-might-be-easier-than-saving-in-the-bank/

- https://www.capitalone.com/bank/money-management/banking-basics/should-i-open-a-savings-account/

- https://finance.yahoo.com/personal-finance/alternatives-to-savings-accounts-121228973.html

- https://www.chase.com/personal/banking/education/basics/pros-and-cons-of-a-high-yield-savings-account

- https://www.usnews.com/banking/articles/how-many-bank-accounts-should-i-have

- https://smartasset.com/financial-advisor/where-do-millionaires-keep-their-money

- https://time.com/personal-finance/article/how-many-bank-accounts-should-you-have/

- https://nomadcapitalist.com/finance/where-rich-people-keep-their-money/

- https://www.beebehealthcare.org/health-hub/benefits-saving

- https://wallethub.com/answers/cs/why-is-my-credit-score-low-when-i-have-no-credit-card-2140841158/

- https://www.investopedia.com/terms/s/savingsaccount.asp

- https://www.equifax.com/personal/education/credit-cards/articles/-/learn/how-many-credit-cards-should-i-have/

- https://www.experian.com/blogs/ask-experian/do-you-need-credit-score-to-open-bank-account/

- https://www.experian.com/blogs/ask-experian/credit-education/improving-credit/how-to-fix-a-bad-credit-score/

- https://www.cnbc.com/select/credit-scores-opening-bank-accounts/

- https://money.com/money-market-vs-cd/

- https://www.huntington.com/learn/saving/savings-account-advantages

- https://www.cnbc.com/select/can-you-have-too-much-money-in-checking-account/

- https://www.ally.com/stories/save/savings-by-age-how-much-to-save-in-your-20s-30s-40s-and-beyond/

- https://www.moneylion.com/learn/why-is-my-credit-score-so-low-if-i-have-no-debt/

- https://www.consumerfinance.gov/ask-cfpb/can-i-open-checking-or-savings-accounts-with-more-than-one-bank-at-a-time-en-919/

- https://www.unbiased.co.uk/discover/personal-finance/budgeting/does-switching-bank-accounts-affect-your-credit-score

- https://www.equifax.com/personal/education/credit/score/articles/-/learn/what-is-a-good-credit-score/

- https://bankmas.co.id/en/blog/kelebihan-menabung-di-bank/

- https://www.experian.com/blogs/ask-experian/pros-and-cons-of-savings-accounts/

- https://www.usbank.com/home-loans/mortgage/first-time-home-buyers/credit-score-for-mortgage.html

- https://www.nerdwallet.com/article/banking/how-much-interest-can-i-earn-on-100-1k-or-10k

- https://www.myfico.com/credit-education/credit-scores/whats-not-in-your-credit-score

- https://www.citizensbank.com/learning/50-30-20-budget.aspx

- https://www.equifax.com/personal/education/credit/score/articles/-/learn/why-credit-scores-may-drop-after-paying-off-debt/

- https://www.genisyscu.org/genisys-blog/pros-and-cons-of-saving-vs-investing

- https://www.bankrate.com/finance/credit-cards/living-paycheck-to-paycheck-statistics/

- https://www.key.com/personal/financial-wellness/articles/how-much-cash-for-emergencies.html

- https://uca.edu/police/crime-prevention/atm-safety-and-security-recommendations/

- https://groww.in/blog/best-savings-bank-accounts-you-can-opening

- https://www.lendingclub.com/resource-center/personal-savings/understanding-average-americans-savings-by-age

- https://banzai.org/wellness/resources/rule-of-72-calculator-by-years

- https://www.experian.com/blogs/ask-experian/credit-education/score-basics/what-affects-your-credit-scores/

- https://www.bankrate.com/banking/does-closing-bank-accounts-hurt-credit/

- https://www.investor.gov/additional-resources/information/youth/teachers-classroom-resources/risk-and-return

- https://www.cnbc.com/select/how-bank-accounts-impact-credit/

- https://www.forbes.com/advisor/banking/how-many-bank-accounts-should-i-have/

- https://www.forbes.com/advisor/banking/checking-vs-savings-accounts/

- https://www.fool.com/the-ascent/banks/how-many-accounts/

- https://lyonswealth.com/blog-details/how-much-money-do-i-need-to-invest-to-make-3000

- https://www.cnbc.com/select/can-you-have-too-much-in-savings/

- https://homework.study.com/explanation/a-drawback-of-a-regular-savings-account-is-a-a-low-rate-of-return-b-a-minimum-required-deposit-c-not-being-insured-d-a-possible-penalty-for-early-withdrawal-e-all-of-these-are-drawback-of-a-regular-savings-account.html

- https://www.investopedia.com/ask/answers/12/safest-place-for-money.asp

- https://cred.club/check-your-credit-score/articles/how-to-raise-your-credit-score-by-200-points-in-30-days

- https://www.creditspring.co.uk/blog/does-opening-a-bank-account-affect-your-credit-score

- https://www.moneysupermarket.com/current-accounts/multiple-bank-accounts/

- https://www.capitalone.com/learn-grow/money-management/why-did-my-credit-score-drop/

- https://www.usatoday.com/money/blueprint/banking/savings/should-you-open-a-savings-account/

- https://www.self.inc/blog/how-to-get-a-720-credit-score-in-6-months

- https://www.cbsnews.com/news/is-a-high-yield-savings-account-safe/

- https://www.nerdwallet.com/article/finance/credit-repair

- https://www.bankrate.com/loans/personal-loans/credit-score-fall-after-paying-loan/

- https://www.nasdaq.com/articles/7-things-you-must-do-when-your-savings-reach-%2425000